Bitcoin returned above the $ 56,361 mark.

On Monday, November 29, bitcoin rose and went above the $ 56,361 mark, which I have been paying attention to in recent days. Thus, the attempt to break through it turned out to be successful, but bitcoin did not stay below it for long. Since all the decline in recent weeks is still quite noticeable, the current wave marking still does not imply the construction of a new impulsive upward trend section. However, in the case of bitcoin, one cannot rely only on the news background. Suffice it to say that according to the analytical company Glassnode, long-term investors who own at least 13.5 million coins are in no hurry to sell them and in recent days have got rid of only 0.7% of their stocks. And this is at a time when the whole world is shocked by the appearance of a new strain of Omicron, and Jerome Powell's speech shocked the foreign exchange market and caused the stock market to fall. Thus, bitcoin continues to demonstrate amazing resistance to negative factors. But, on the other hand, whatever the factors, if investors do not sell coins, then bitcoin will not get cheaper. At the moment, the cryptocurrency is at a point where it is necessary to talk about its prospects.

Risky assets are dumped first, but not Bitcoin.

Although the markets have been shaken by several high-profile events and news in the last week, bitcoin has not continued to decline. Let me remind you that the chances of tightening the Fed's monetary policy continue to grow, although it has already begun to curtail QE. As many analysts note, with the tightening of the Fed's policy, the demand for bitcoin and other risky assets will decrease, as investors will move into more stable assets, the profitability of which will increase with an increase in the interest rate. But at this time, this factor may not work, since high inflation persists all over the world. Recently it became known that inflation in the European Union has already jumped to 4.9% y/y, and not only American investors are buying bitcoin. Therefore, I think that it is high inflation that keeps the cryptocurrency from falling more strongly than the one it has demonstrated in recent weeks. Based on this, I believe that a combination of two factors is required that will allow the downward section of the trend to continue its construction. Inflation must begin to decline, and the central banks of the European Union and the United States begin to tighten monetary policy. This may take quite a long time, so next year may also be quite successful for bitcoin.

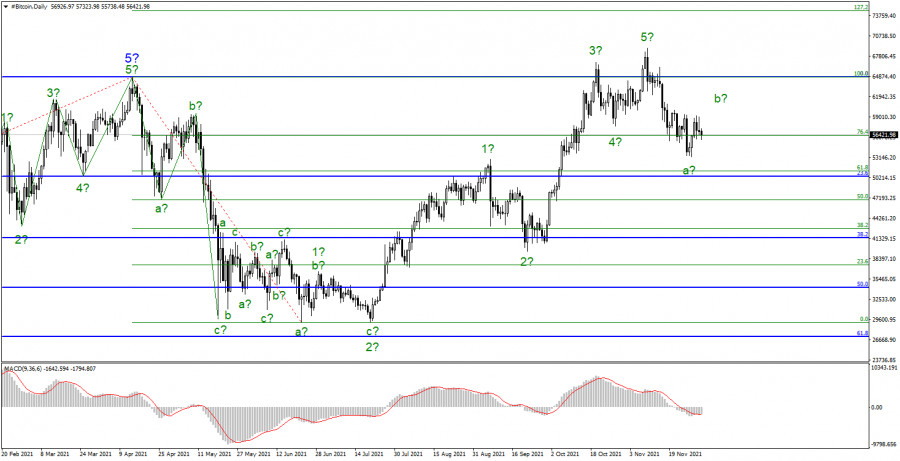

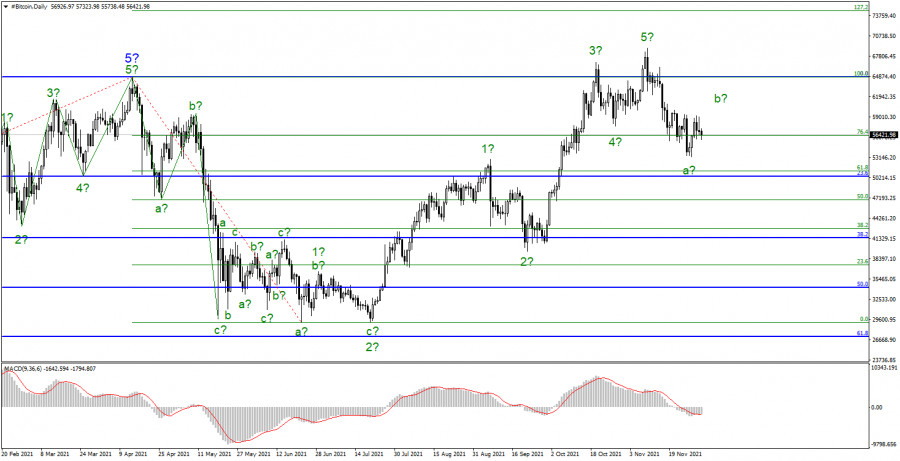

The current upward section of the trend still does not cause any doubts. The wave pattern was refined after the instrument made a successful attempt to break through the maximum of the assumed wave 3. Now the whole picture looks like a completed five-wave impulse upward trend section, which began its construction on July 20. The departure of quotes over the past three weeks from the reached highs may mean the end of the expected wave 5, which in this case turned out to be shortened. At the moment, I'm leaning towards this option. There is no alternative option at this time since the tool does not try to resume the construction of an upward trend section. This option cannot be completely dismissed, however, if we start only from the wave marking, then now at least a three-wave downward trend section should be built with targets located near the estimated marks of $ 51,200 and $ 46,900. Consequently, the construction of a corrective wave b could now begin, after which the decline of the instrument will resume with the designated goals.