The EUR/USD currency pair resumed its upward movement on Tuesday. We have already said earlier that the euro is now objectively less likely to grow than the pound. Still, at the same time, it should be recognized that the euro is above the moving average, and any new trend begins with overcoming the moving average line. So far, everything is going according to plan. The euro is growing. It is still growing within the boundaries of the average correction over the past year and a half. Recall that the maximum correction for this period was 400 points. So far, this milestone has not been overcome. Therefore, given the fundamental and geopolitical backgrounds, the European currency may resume its long-term downward trend.

The situation is very ambiguous right now because the longer any trend lasts, the more likely it is that it will end in the near future. The pair cannot constantly move in the same direction, and at some point, it may start moving in the countertrend direction without any apparent reason. This is the danger of the situation – the background may remain negative, but the pair may move quite strongly in the opposite direction simply because the "bearish" potential of the market has dried up. Therefore, technical analysis is doubly important now.

Since the euro continues to show growth, it can overcome the critical Kijun-sen line on the 24-hour TF in the near future. Recall that this line is the first important boundary for breaking any long-term trend. If this line skips the price, the probability of growth to the Senkou Span B line (1.0257) on the same TF will increase sharply. And this is the growth potential for another 350 points. In this case, the correction will already be 750 points, which, you will agree, is a significant amount for a new upward trend.

A preemptive nuclear strike

The fundamental background has been absent in recent days. But there is plenty of geopolitical news. It should be noted right away that the probability of a nuclear strike on the territory of Ukraine is growing every day. This is now openly stated by many military experts and political scientists. The fact is that Vladimir Putin and some members of the Russian government have repeatedly stated that after the adoption of Ukrainian territories into the Russian Federation, any strike on these territories will be regarded as an encroachment on the security of the entire Federation. Over the past few days, the Ukrainian Armed Forces have de-occupied another two dozen settlements in the Kharkiv and Kherson regions. These actions of the Ukrainian army could already become the basis for a nuclear strike.

Most experts agree that there will be no full-scale nuclear war in the near future. They believe that the Kremlin may decide to demonstrate a nuclear explosion, for example, in the Black Sea. Naturally, it will be of great importance at what distance from the shore the detonation will be made. If it is close, a tsunami may occur, from which coastal settlements will suffer greatly. And in any case, implementing the "nuclear scenario" will cause a huge dissonance in the world community.

There is no doubt that new "retaliatory measures" by the West will follow, which this time will not be limited to simple sanctions. Washington has openly stated that in the event of a nuclear strike by the Kremlin, the entire Black Sea Fleet of the Russian Federation will be destroyed, and retaliatory strikes against command posts can also be carried out. Whatever it was, we are talking about a new escalation. And the escalation is no longer between Ukraine and the Russian Federation, but between the Russian Federation and most of the rest of the world. The world has not seen the use of nuclear weapons since Hiroshima and Nagasaki, so even if it is a demonstration explosion in the Black Sea or a low-power strike on the positions of the Armed Forces of Ukraine, in any case, the reaction of the West will follow. And with these events, the US dollar may well regain its leading position in the foreign exchange market. If earlier the dollar was growing because of Ukraine's military conflict, imagine what could happen if an exchange of nuclear strikes began.

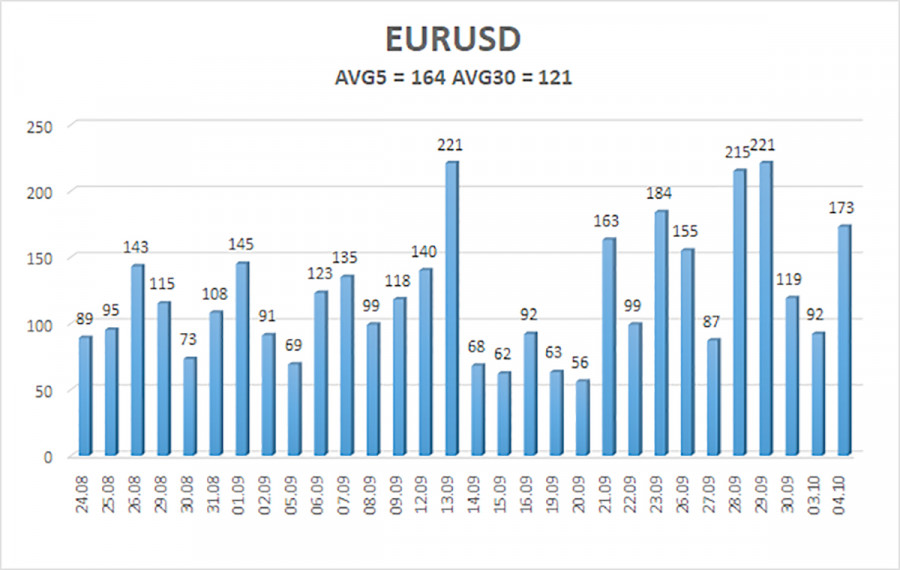

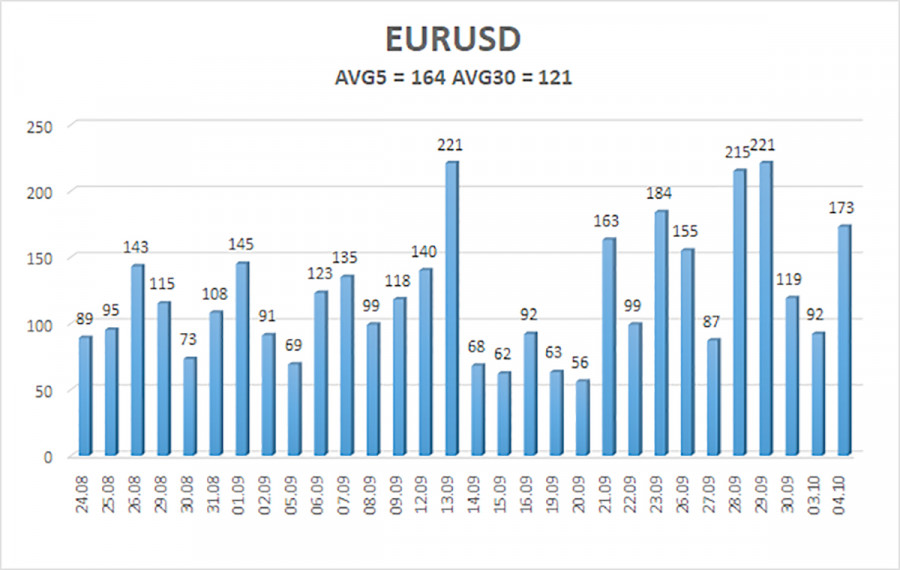

The average volatility of the euro/dollar currency pair over the last five trading days as of October 5 is 164 points and is characterized as "very high." Thus, we expect the pair to move between the levels of 0.9804 and 1.0132 on Wednesday. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 0.9888

S2 – 0.9766

S3 – 0.9644

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0132

R3 – 1.0254

Trading Recommendations:

The EUR/USD pair remains above the moving average line and continues to move up. Thus, it would be best if you stayed in long positions with targets of 1.0010 and 1.0132 until the Heiken Ashi indicator turns down. Sales will become relevant again no earlier than fixing the price below the moving average with a target of 0.9644.

Explanations of the illustrations:

Linear regression channels help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.