The euro-dollar pair continues to trade in the range of 1.0450-1.0600, within which it has been for the second week. Both bears and bulls of EUR/USD do not want to put up with this state of affairs: they have repeatedly tried and are still trying to leave this range, making a price breakthrough. For example, over the past two days, the initiative has been taken by the bears of the pair, who seek to improve their position by gaining a foothold in the area of the 4th figure. Up to this point, the ball was on the side of the EUR/USD bulls: they, in turn, tried to stay above the 1.0600 mark.

At the moment, the parties are losing: both bulls and bears. Traders hesitate to hold trading positions after the price crosses the borders or even approaches the borders of the above range. Therefore, today it is equally risky to go into short or long positions.

In my opinion, the market is frozen in anticipation of tomorrow's release of data on the growth of the basic price index of personal consumption expenditures in the United States (PCE). This fundamental factor can provoke strong volatility in the pair, pushing it out of the price echelon.

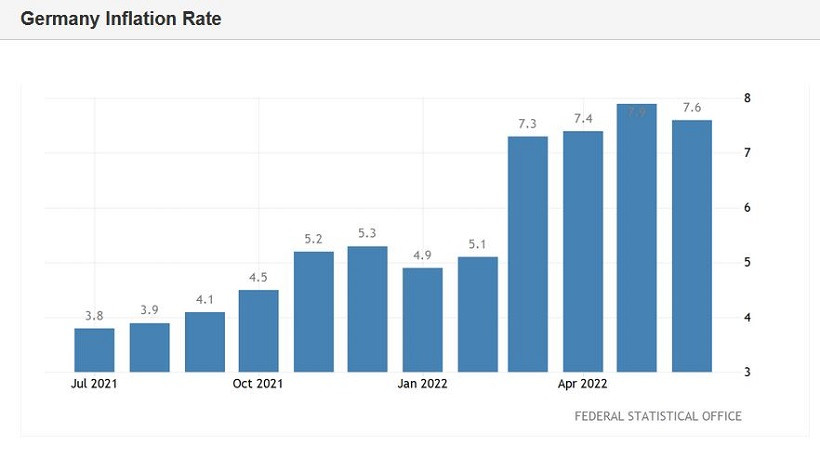

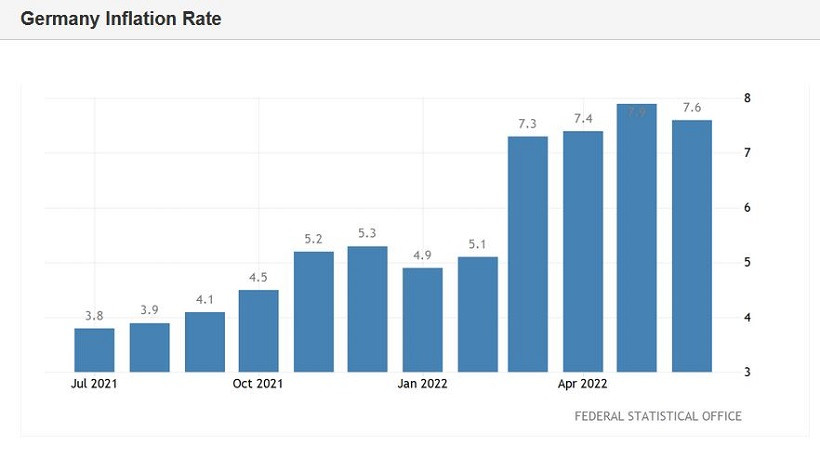

Today's fundamental background is contradictory. Data on the growth of the German consumer price index were published during the European session. The report reflected an unexpected slowdown in the growth of inflation in Germany. All components of the data were in the red zone, contrary to the forecasts of most experts. In annual terms, the overall consumer price index came out at around 7.6%, with growth forecast to reach 8.0%. This indicator has been consistently increasing since February 2021, and in the spring of this year it began to gain momentum sharply, exceeding the 7% mark and thereby updating the 48-year record. However, the June result unexpectedly reflected a slowdown in growth, instead of the predicted breakthrough to the 8% target.

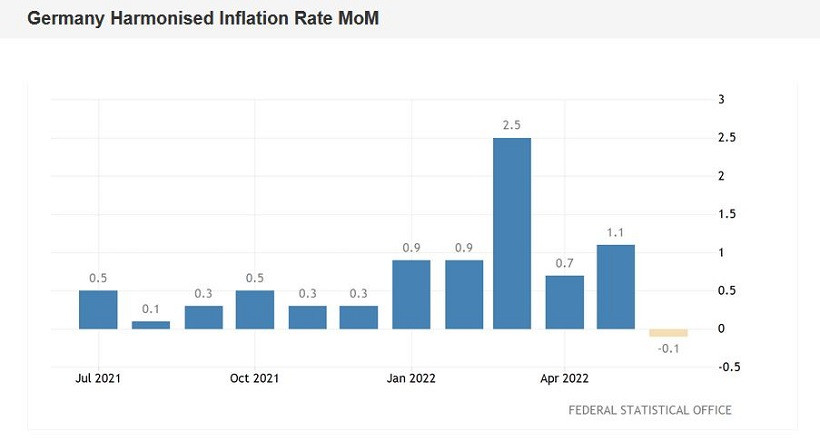

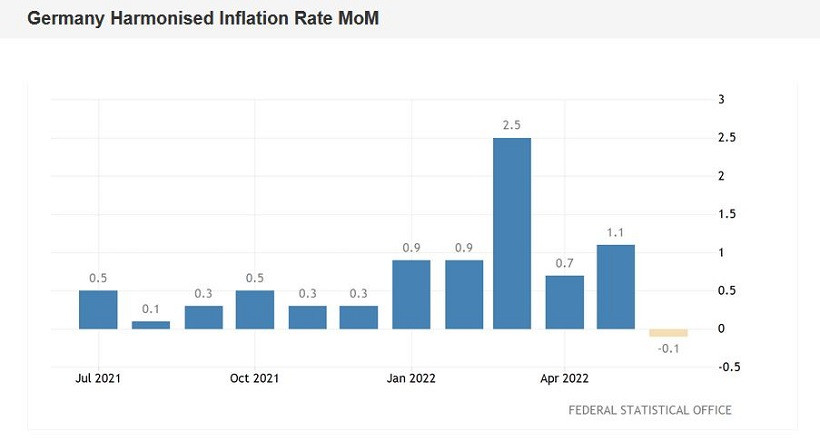

The indicator also fell short of the forecast values on a monthly basis, ending up at 0.1% in June (after an increase of 0.9% in May). The harmonized consumer price index similarly came out in the red zone – both in monthly and annual terms. The core index even dropped into the negative area on a monthly basis (-0.1%) – for the first time since January last year.

It is worth noting that German data quite often correlate with pan-European ones, so we can assume that the June inflation growth in the eurozone (the release is scheduled for Friday, July 1) may also disappoint. And here it is necessary to recall the words of European Central Bank President Christine Lagarde, who last week in the European Parliament said that the September increase is still an unresolved issue, they say, the central bank can raise its interest rates in September "if the situation requires it." At the same time, she assured MEPs that in July the rate will be increased by only 0.25%. A little later, at a forum in the Portuguese city of Sintra, she somewhat toughened her position, noting that the ECB is ready for a more drastic tightening of policy to curb inflation "if the situation requires it."

In other words, Lagarde retains room for maneuver in the context of further actions after the July meeting. If pan-European inflation shows the first signs of slowing growth on Friday, then the September rate hike will again be in question. The first alarm bell sounded today – German inflation has suspended its growth, contrary to the opposite forecasts of most experts.

The US dollar, in turn, was also under background pressure today. The fact is that the final estimate of US GDP growth in the first quarter was just released. The final result was revised downwards – from -1.5% to -1.6% in annual terms. But this fundamental factor had a short-term impact on the greenback. After all, judging by the results of the Federal Reserve's June meeting, the members of the US central bank are ready to fight high inflation even at the cost of a possible recession. Therefore, traders actually ignored a slight deterioration in the initial estimate of GDP growth.

In addition, Fed Chairman Jerome Powell had provided support to the dollar today, who spoke at the economic forum in Sintra. And although he limited himself to general phrases (without specifics about the pace of rate hikes in July and September), Powell made it clear that the central bank is ready to tighten monetary policy until inflationary growth is reversed. This rhetoric has put additional pressure on the EUR/USD pair.

However, despite the general strengthening of the US currency and disappointing data on inflation growth in Germany, at the moment it is advisable to take a wait-and-see position on the pair. I repeat – tomorrow's report on the growth of the basic price index of personal consumption expenditures may "redraw" the fundamental picture. Let me remind you that dollar bulls reacted very painfully to the decline in the consumer confidence index calculated by the University of Michigan. If PCE also turns out to be disappointing tomorrow, EUR/USD bulls may return to the borders of the 6th figure again.