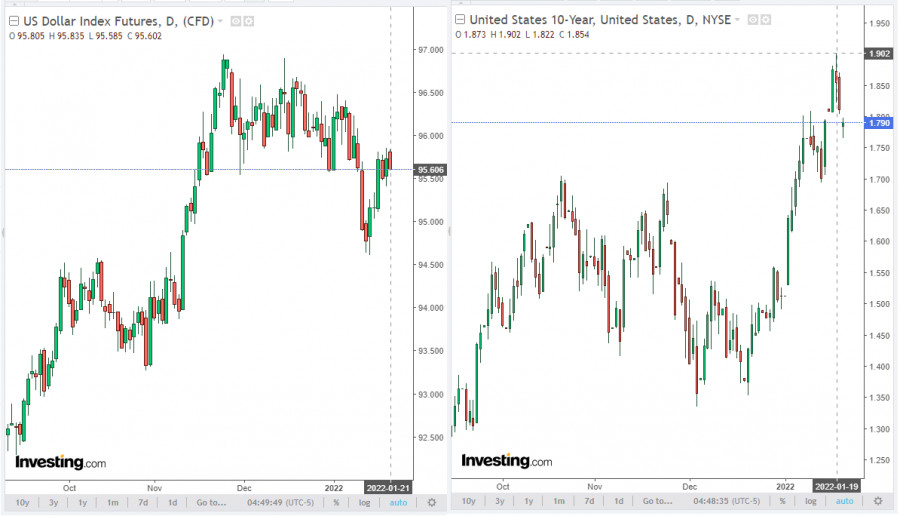

The demand for protective yen, franc, and government bonds has risen sharply on Friday. At the same time, quotes of commodity currencies fell sharply, along with the continued decline in futures for the world's major stock indices. Accordingly, the growth in demand for government bonds leads to a drop in their yield and dollar quotes as a national currency. Thus, the yield on the U.S. 10-year Treasury at the time of writing is 1.790%, below the maximum since February 2020 at 1.902%.

Such yields were observed on the eve of the March emergency Fed meetings, when the interest rate was sharply reduced from 1.75%, first to 1.25%, and then to the current 0.25%.

Anxiety and uncertainty are growing again in the markets, and the U.S. currency, it seems, cannot yet decide on the direction of further movement. Thus, futures for the DXY dollar index are currently trading near 95.60 after rising on Tuesday, falling on Wednesday, and rising again on Thursday.

Expectations of the start of the Fed's interest rate hike cycle support its quotes. The minutes of the Fed's December meeting, released earlier this month, hinted at a propensity for a sharper reduction in the central bank's balance sheet and the possibility of an earlier start to the interest rate hike cycle.

But, on the other hand, according to some economists, a further decline in U.S. stocks and stock indices may lead to an outflow of capital from U.S. assets, and this will negatively affect the dollar.

As the U.S. Department of Labor reported yesterday, the number of initial claims for unemployment benefits unexpectedly increased, amounting to 286,000 (against the forecast of 220,000 and previous values of 231,000, 207,000, 200,000). This is an alarming signal for dollar buyers, as the data presented indicate a deterioration in conditions in the U.S. labor market.

Negative dynamics has been observed for the fourth week in a row, and the average value of the number of initial claims for unemployment benefits registered in the last 4 weekly reports of the U.S. Department of Labor amounted to 231,000 in the current reporting week (against 211,000, 204,500, 199,750 in the previous 4-week periods). This indicator more objectively reflects the state of affairs in the national labor market, and its growth indicates a deterioration of the situation and is an unfavorable factor for the USD.

Despite strong monthly reports and a low unemployment rate of 3.9%, the lowest since March 2020, the number of jobs in the U.S. economy is still 3.6 million fewer than before the pandemic.

But the dynamics of the labor market (together with the inflation rate and the dynamics of GDP) is a determining factor for the Fed in planning the course of monetary policy, and the deterioration of the labor market may once again force Fed officials to refrain from quickly curtailing the stimulus program. And this, in turn, will again negatively affect the dollar.

As for today's economic calendar and upcoming events, market participants, especially those who follow the dynamics of commodity currencies, will pay attention to the publication of the retail sales index by Statistics Canada at 10:30 UTC. This indicator evaluates the total volume of retail sales and is considered an indicator of consumer confidence, reflecting the state of the retail sector in the near future. An increase in the index is usually a positive factor for CAD; a decrease in the indicator will have a negative impact on CAD.

According to the forecast, retail sales are expected to have increased by +1.2% in November after an increase of +1.6% in October and after a decrease of -0.6% in September. If the data for November turns out to be weaker than the forecast, CAD may decline sharply in the short term, and the USD/CAD pair may grow.

The Canadian dollar is also losing support today from declining oil prices. According to the report of the Energy Information Administration of the U.S. Department of Energy, published on Thursday with data on weekly changes in commercial oil and petroleum reserves, in the week of January 8-14, they increased by 0.515 million barrels (against the forecast of a drop of -0.938 million barrels).

Oil market analysts still expect a resumption of price growth, as supply is likely to remain limited and demand is stable. In this case, CAD quotes will also start to grow again, and USD/CAD (with neutral dynamics of USD), respectively, will decrease.

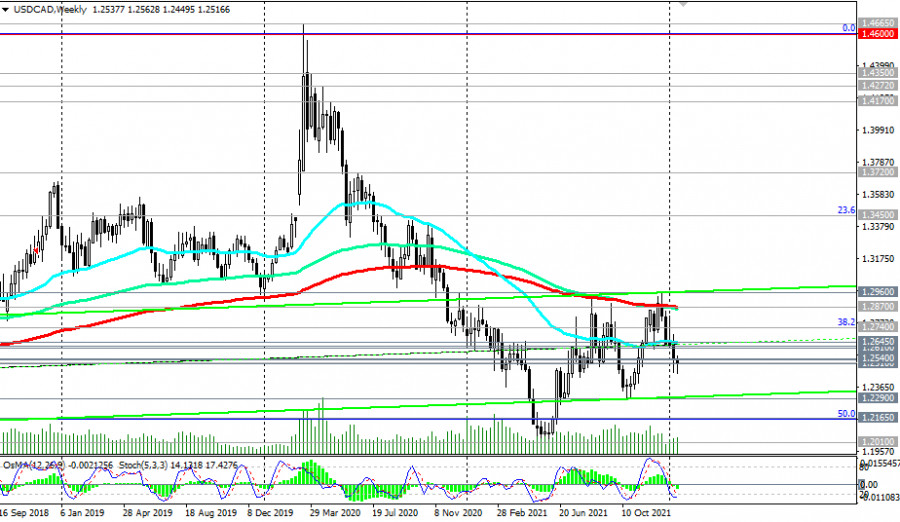

It is also worth paying attention to the monthly USD/CAD chart, where the price has come up against a strong support in the zone of long-term levels 1.2535, 1.2510 (200 and 144-day MA). Accordingly, from a technical point of view, a breakdown of the local support levels at 1.2450 and resistance at 1.2560 (weekly lows and highs) will indicate the direction of further USD/CAD dynamics.

Support levels: 1.2510, 1.2450, 1.2290, 1.2165, 1.2010

Resistance levels: 1.2535, 1.2540, 1.2560, 1.2610, 1.2620, 1.2645, 1.2740, 1.2870, 1.2900, 1.2960

Trading recommendations

Sell Stop 1.2490. Stop-Loss 1.2550. Take-Profit 1.2450, 1.2400, 1.2290, 1.2165, 1.2010

Buy Stop 1.2550. Stop-Loss 1.2490. Take-Profit 1.2560, 1.2610, 1.2620, 1.2645, 1.2740, 1.2870, 1.2900, 1.2960